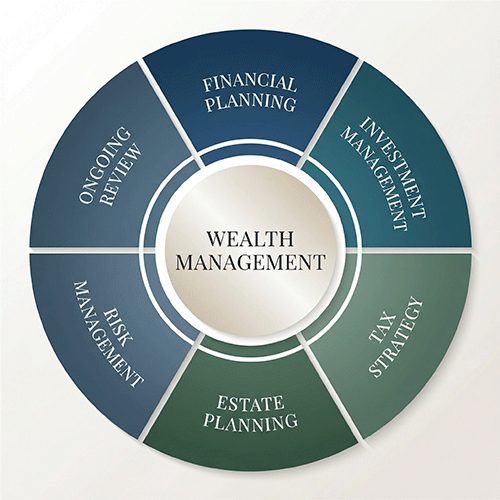

Wealth Management

Wealth management is comprehensive financial guidance designed to help you achieve a secure and fulfilling retirement. At Wickford Wealth Management, we bring all the pieces of your financial life together into one cohesive strategy.

We start by understanding your goals, then create a personalized retirement plan that addresses every aspect of your financial picture—from tax-efficient investing and income planning to estate strategies and insurance protection. As your trusted fee-only fiduciary advisor, we provide ongoing guidance and adjust your plan as your life evolves, ensuring you stay on track toward the retirement you've always envisioned.

Our wealth management approach means you have a dedicated partner focused on your long-term success, coordinating all the moving parts so you can move forward with clarity and confidence.

A Financial Plan as Unique as You

Financial planning isn’t one-size-fits-all. We help you craft a personalized income strategy that supports your lifestyle goals and ensures your financial resources endure, bringing clarity and confidence to your future.

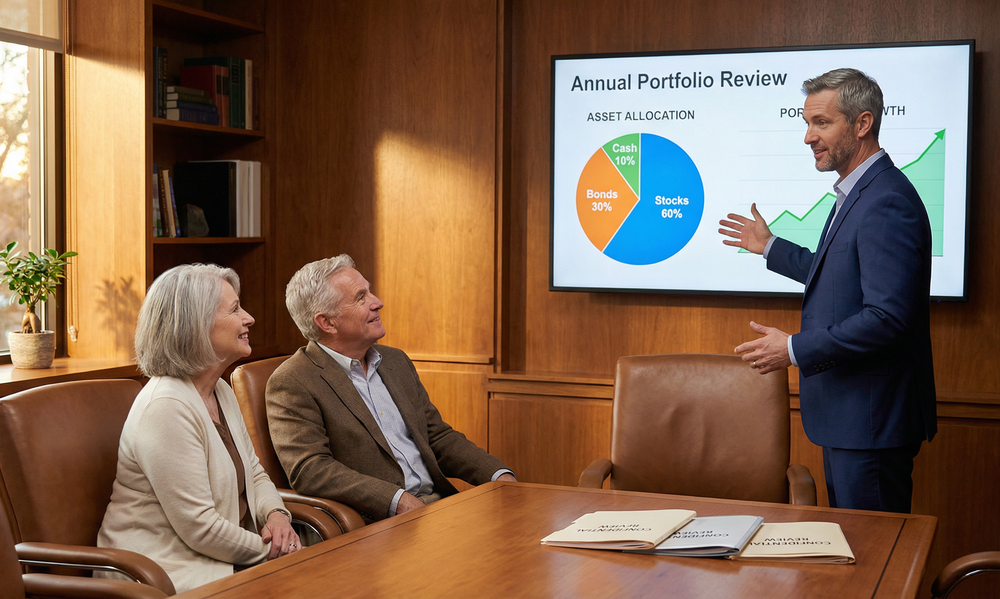

Investment Guidance Built Around You

We provide personalized investment guidance that reflects what matters most to you: how much risk feels right, what you’re working toward, and when you need to reach your goals. Your portfolio becomes a strategic tool supporting your overall financial vision.

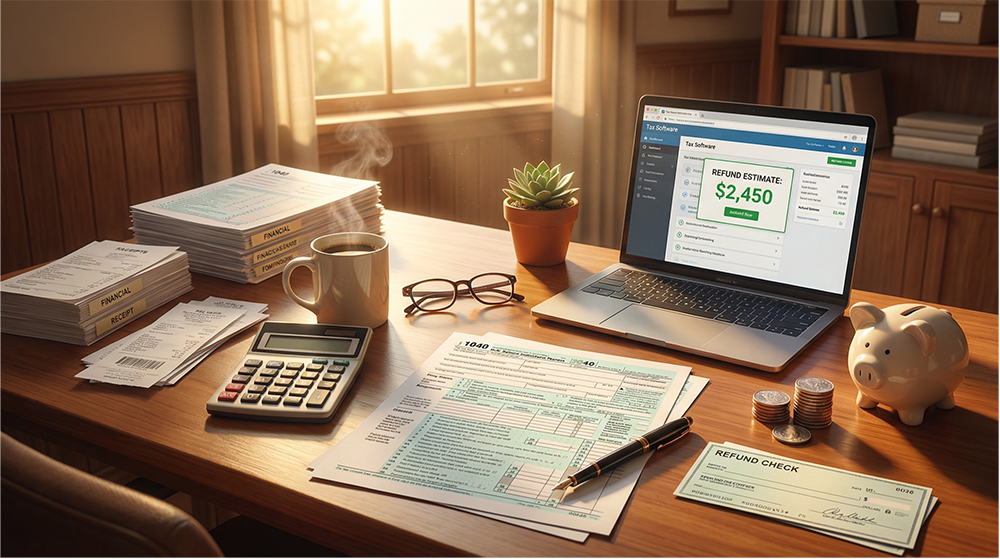

Strategic Tax Planning

Expert tax planning is a powerful tool for saving more and maximizing your financial resources. By understanding tax laws and utilizing available strategies, you can reduce your tax burden and keep more of your income.

Estate Planning

We guide you through protecting and passing on what matters most—with understanding, empathy, and attention to detail. Collaborating with your attorneys and accountants, we design estate plans that celebrate your life’s work and embody what you stand for.

Planning for Life's Uncertainties

We help you protect what matters most—your family’s financial security and peace of mind. Through careful risk assessment and thoughtful recommendations, we work alongside your insurance professionals to coordinate life, disability, and long-term care coverage that shields you and your loved ones from life’s uncertainties.

Ongoing Plan Reviews & Guidance

Your financial plan isn't set-it-and-forget-it—it's a living strategy that evolves with your life. We conduct regular reviews of your retirement plan, investment portfolio, and financial goals to ensure you stay on track. As markets shift, tax laws change, and your priorities evolve, we proactively adjust your strategy and provide the guidance you need to navigate confidently through every stage of retirement.